estate tax return due date canada

For the Assessment Year 2022-23 the due date for return filing as per section 1391 is 31st July 2022 unless extended by the government. Tax Rates - current and prior years tax brackets and combined federalprovincial marginal tax rates for eligible and non-eligible Canadian dividends capital gains.

Income Tax Filing Is It Compulsory To All Capital Gains Tax Estate Tax Money Market

The post-bankruptcy tax return covers all of the tax items from the date of bankruptcy to December 31.

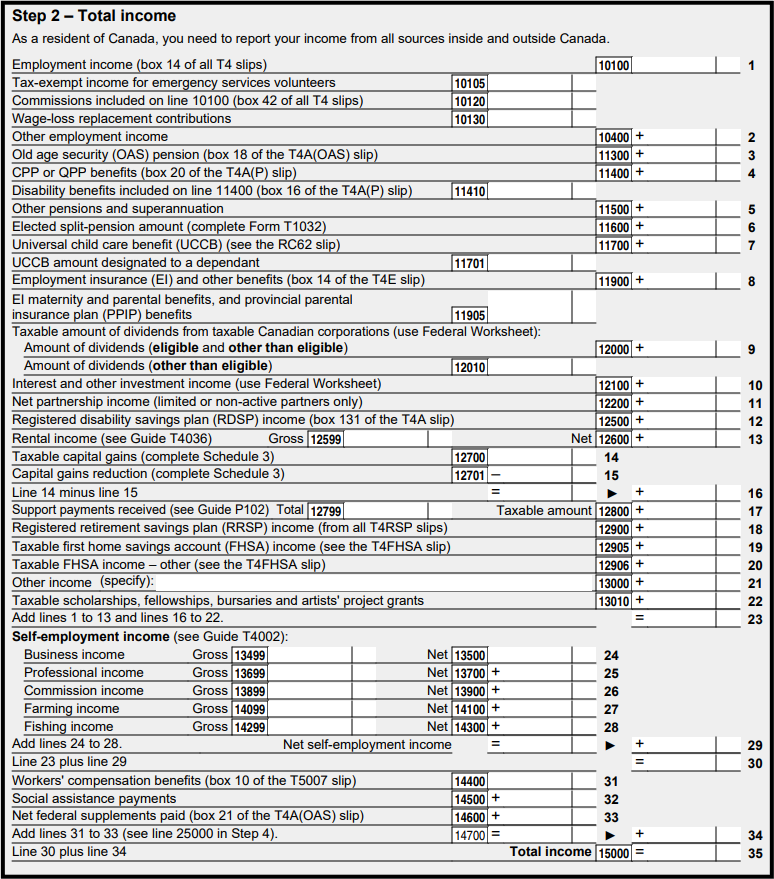

. Most real estate agents and brokers receive income in the form of commissions from sales transactions. Estate and Gift Taxes. The amounts reported on lines 10100 - 14600 determine the deceased persons total income by using the common types of income for a final return.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. Tax Compliance and Complexity. Out of Date Evidence.

The trustee is responsible for filing Form 706-QDT and paying any estate tax due. Tax Foundation is Americas leading independent tax policy resource providing trusted nonpartisan tax data research and analysis since 1937. Estate tax return.

Estate tax return preparers who prepare any return or claim for refund that reflects an understatement of tax liability due to an unreasonable position are subject to a penalty equal to the greater of 1000 or 50 of the income earned or to be earned for the preparation of each such. Due date for filing the income tax return for FY 2021-22 for the individuals not required for tax audit is 31st July 2022. FDA Menthol.

HR Block at Home formerly TaxCut is the second most popular with a 14 shareOther popular tax software includes. Global Tax Deal. An in-bankruptcy tax return covers any income from liquidated assets along with information about any of your creditors who receive a payment resulting from your companys liquidation.

COVID-19 Benefits - T4A Tax Slip Errors. 90000 annual income 48536 2nd bracket minimum 41465 x 2nd bracket rate of 205 1st bracket maximum total tax of 7280 Heres another example albeit perhaps not very. TaxACT at 7 Tax Hawk including FreeTaxUSA at 59 Credit Karmas free tax software now owned by.

TurboTax Online Free Edition customers are entitled to payment of 30. The return filing date for the individuals required to audit their books of. The T3 Trust Return.

Expenditures Credits and Deductions. The T3 tax year starts the day after the death date and the end date can be any. If the surviving spouse is the beneficiary of more than one QDOT the executor of the decedent who created the trusts may identify a designated filer on either the decedents estate tax return or on the first Form 706-QDT which is filed.

Due dates for filing personal tax returns in Canada Personal Income Tax Calculators RRSPRRIF calculators investing calculators and more. Lines 001 to 082 of page 1. If the deceased earned foreign income or owned or held foreign property at any time in 2021 see Report foreign income and other foreign amounts in the Federal Income Tax and Benefit Guide.

TurboTax is the most popular tax preparation software in the United States holding a 666 market share of self-prepared returns in 2018. Lines 164 170 and 171 of page 2. All returns except for the post-bankruptcy return are.

If you carried on a treaty-protected business in Canada or disposed of a taxable Canadian property that was treaty-protected property during the year as defined in section 248 you have to complete all of the following lines on your return. The other optional Returns such as Return for a Partner or Proprietor and the Return of Income from a Graduated Rate Estate are due on the same date as the final return. Youre generally not considered an employee under federal tax guidelines but rather a self-employed sole proprietor even if youre an agent or broker working for a real estate brokerage firm.

Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back. This self-employed status allows you to deduct many of the. Calculating the total income.

The T3 Trust return is due 90 days from the end of the trusts tax year. Non-resident corporations claiming treaty exemption.

When Can I File My 2021 Taxes In Canada Loans Canada

Canadian Tax Return Deadlines Stern Cohen

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

![]()

When Can I File My 2021 Taxes In Canada Loans Canada

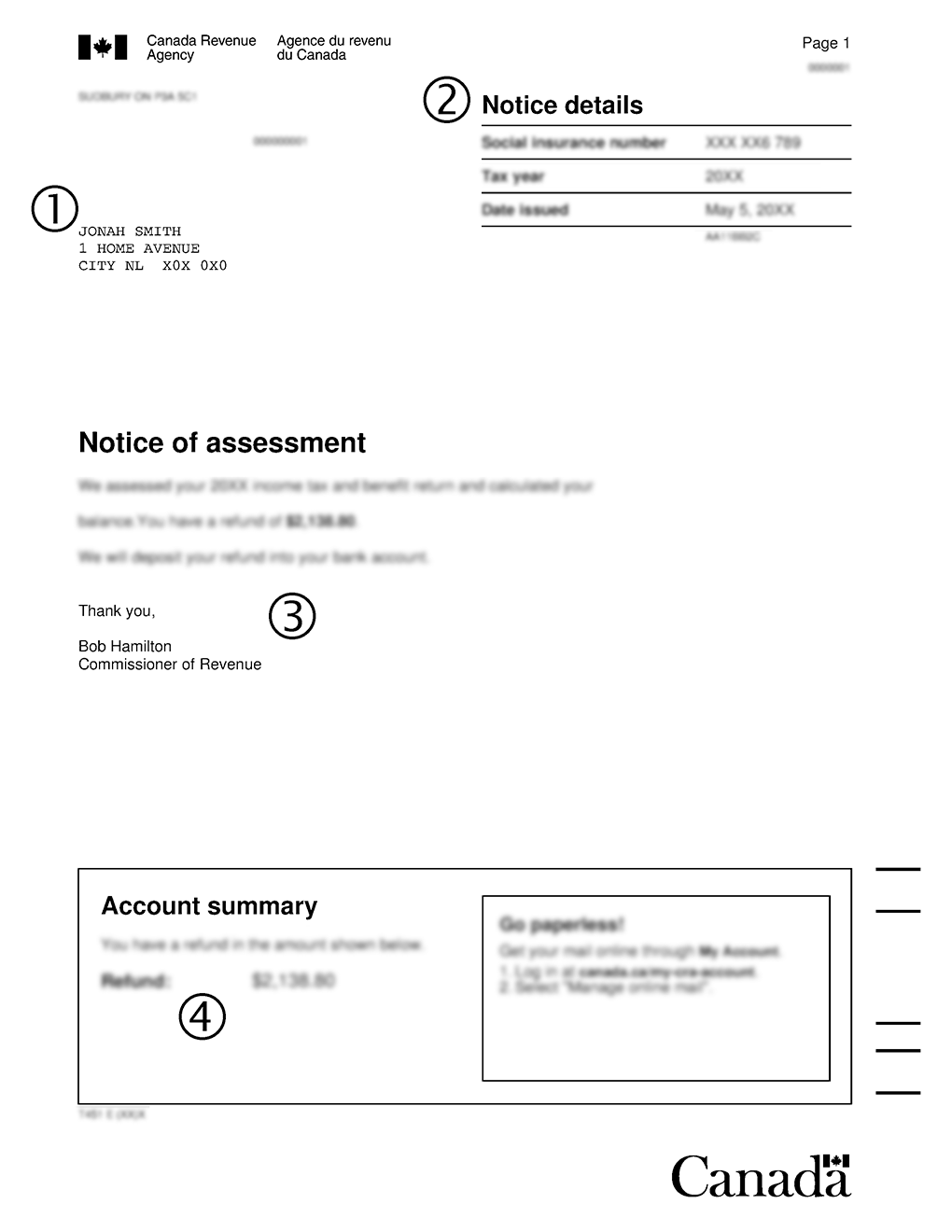

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca

2021 Taxes Everything You Need To Know Ctv News

Late Or Unfiled Tax Help Get Help With Past Due Tax Returns We Can Help Minimize Or Even Avoid Late Filing Penalties Debt Relief Programs Tax Debt Tax Help

Filing The T3 Tax Return Advisor S Edge

Money Dates 2018 Dating Personals How To Plan Money

30 Day Notice To Vacate Pdf Rental Property Management Property Management Real Estate Investing Rental Property

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

Estate Trustee During Litigation The Good And Practical Way To Safeguard Assets During Estate Litigat1on Ira Smithtrustee Receiver Inc Brandon S Blog Litigation Estates Extraordinary Measures

After Sending Us Your Tax Return Learn About Your Taxes Canada Ca